India GST Collection Hits Record High of Rs 2.10 Lakh Crore in April

India

India's GST collections surged to an all-time high of Rs 2.10 lakh crore in April 2024, driven by a 12.4% year-on-year growth, fueled by increased domestic transactions and enhanced compliance measures. This milestone underscores the resilience of India's tax system and its positive impact on government revenue and economic stability.

India’s gross Goods and Services tax (GST) collections rose to a record-high level of Rs 2.10 lakh crore in April (for year-end sales in March), data released by the Finance Ministry on Wednesday (May 1) showed.

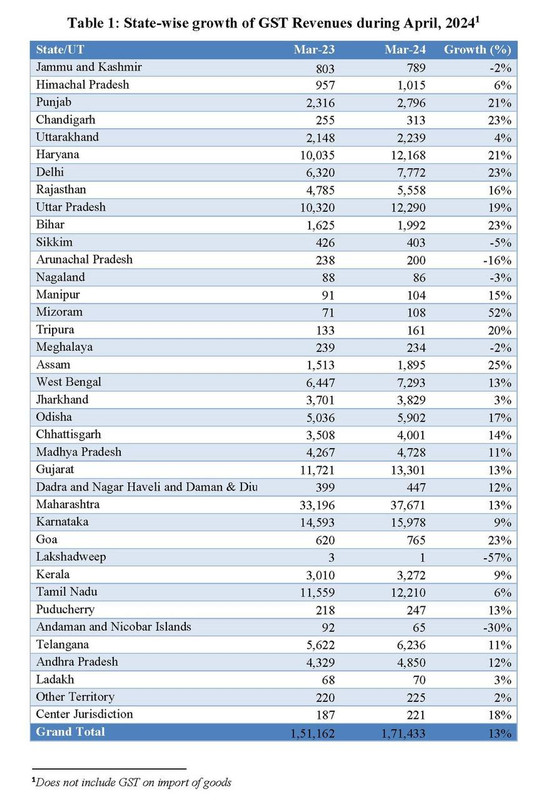

State wise GST revenue growth from March 2023 to March 2024.

Driven mainly by a rise in domestic transactions, which increased 13.4 per cent year-on-year along with a higher compliance in the backdrop of anti-evasion measures being taken by authorities, the gross GST collections increased by 12.4 per cent in April.

This is the highest level of GST collections recorded since the July 2017 of the indirect tax regime. The previous highest level registered under GST was Rs 1.87 lakh crore in April 2023, reflecting year-end sales of March 2023.

After accounting for refunds, the net GST revenue for April 2024 was at Rs 1.92 lakh crore, an increase of 15.5 per cent from the corresponding period last year.

“The Gross Goods and Services Tax (GST) collections hit a record high in April 2024 at Rs 2.10 lakh crore. This represents a significant 12.4 per cent year-on-year growth, driven by a strong increase in domestic transactions (up 13.4 per cent) and imports (up 8.3 per cent),” the Finance Ministry said in a statement.

In the previous month, on a net basis, taking into account the impact of refunds, GST revenue had risen by 18.4 per cent to Rs 1.65 lakh crore. For the full financial year 2023-24, net GST revenue stood at Rs 18.01 lakh crore, a growth of 13.4 per cent over the corresponding period last year.

In April, out of 38 states/union territories (including Centre’s jurisdiction), 19 states/UTs recorded higher growth in GST collections than the national average of 12.4 per cent growth.

In absolute terms, Maharashtra was at the top with collection of Rs 37,671 crore (13 per cent growth), followed by Karnataka with collection of Rs 15,978 crore (9 per cent growth) and Gujarat with collection of Rs 13,301 crore (13 per cent growth).

Uttar Pradesh followed with Rs 12,290 crore collection (19 per cent growth), Tamil Nadu with Rs 12,210 crore (6 per cent growth) and Haryana with Rs 12,168 crore collections (21 per cent growth).

Tax experts said economic activity and GST audits by authorities have reflected in the record-high collections.

“The consistent growth in GST collections with this one being the highest collection ever is a big cheer and reflects upon the strong domestic economy especially given the fact that growth on account of domestic transactions is 13.4 per cent as compared to imports which is at 8.3 per cent. Another significant reason for this growth could be linked to the deadline for GST audits and corresponding notices issued during this year,” Abhishek Jain, Partner & National Head, Indirect Tax, KPMG said.

“The unprecedented milestone of surpassing Rs 2 lakh crore in GST collections for April 2024 underscores the steadfast resilience of the tax system amidst evolving economic landscapes. Every component of the GST collection has contributed significantly…the concerted efforts of the GST officials including zero tolerance for non-filers, coupled with rigorous measures to combat fake invoicing and the registrations has significantly bolstered GST collections in the state’s coffers,” Saurabh Agarwal, Tax Partner, EY said.

Overall, the total GST collections stood at Rs 2,10,267 crore in April, out of which Central GST — the tax levied on intra-state supplies of goods and services by the Centre — was Rs 43,846 crore, State GST — the tax levied on intra-state supplies of goods and services by the states — was Rs 53,538 crore, Integrated GST — the tax levied on all inter-state supplies of goods and services — was Rs 99,623 crore (including Rs 37,826 crore collected on import of goods) and cess was Rs 13,260 crore (including Rs 1,008 crore collected on import of goods).

In April, the government settled Rs 50,307 crore to Central GST and Rs 41,600 crore to State GST from Integrated GST. As a result, the total revenue for the month post settlement was Rs 94,153 crore for the Centre and Rs 95,138 crore for State GST.